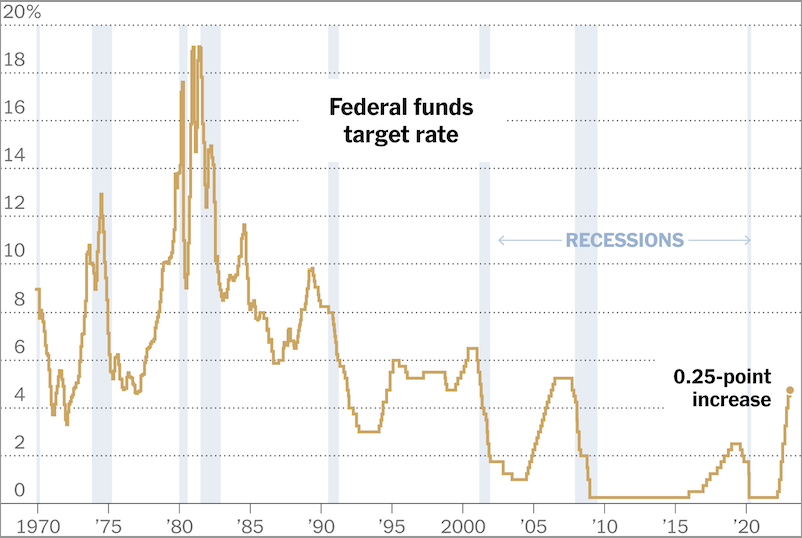

The Federal Reserve has approved another quarter-point increase in interest rates but has signaled that financial turmoil may end its rate-hike campaign sooner than anticipated. This is the ninth consecutive increase in interest rates since last year to combat increased inflation. The new benchmark federal-funds rate range is now at 4.75% to 5% the highest level since September 2007. Jerome Powell, the Fed’s chairman, hinted that Wednesday’s increase may be the last for now, depending on the extent of any lending pullback following the bank run earlier this month. Most of the 18 participants in the meeting expect the fed-funds rate to rise to at least 5.1% this year, which implies another quarter-point rate increase and no rate cuts. Fed officials have acknowledged the risk of being forced to simultaneously fight two problems, financial instability and inflation. Federal Reserve officials have stated that they would use emergency lending tools to stabilize the credit markets as well as continuing to raise interest rates or hold them at higher levels to combat inflation. Several former Fed policy makers have argued that not raising interest rates may raise questions over whether banking problems are more serious than they appear at present. According to Jan Hatzius, Goldman’s chief economist, it is prudent for the Fed to move cautiously given the highly uncertain environment caused by the banking stress.

Source: WSJ.com