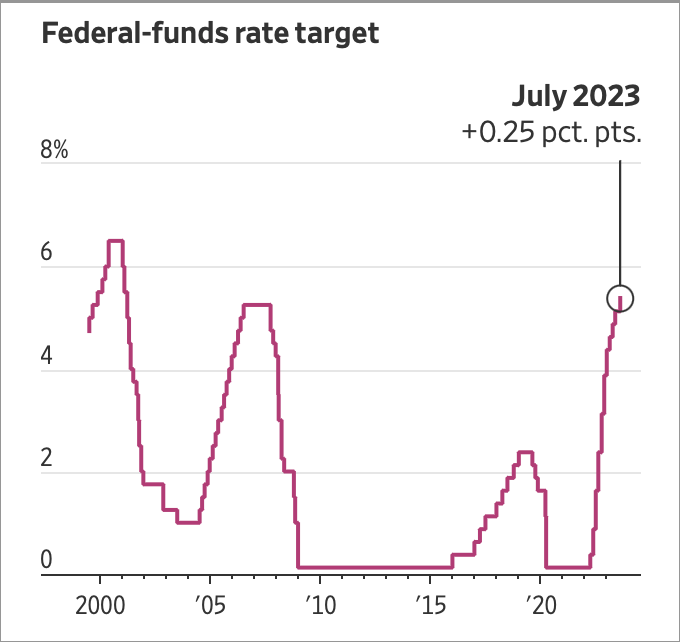

In July, the Federal Reserve raised rates a quarter-percentage-point bringing the benchmark federal-funds rate between 5.25% and 5.5%. The Fed’s decision last month brought the interest rate to its highest level in 22 years, marking the 11th rate increase since March 2022. Jerome Powell, president of the Federal Reserve, indicated that it was too early to determine whether the hike would conclude a series of increases aimed at cooling the economy and lowering inflation. Powell has said ‘Inflation has repeatedly proved stronger than we and other forecasters have expected, and at some point that may change. We have to be ready to follow the data.”

Powell did not rule out another rate increase at the central bank’s September meeting, but he highlighted the amount of work the central bank had already accomplished, as well as the length of time it may take for monetary policy to cool inflation. While some Fed officials have proposed raising rates again at the September meeting, others support a longer pause as they believe the impact of the Fed’s rate hikes has not yet fully taken hold. With the Federal Reserve set to meet three more times this year, some officials are more likely to favor waiting until November or December to determine whether there should be another increase. Fed officials have been concerned that underlying price pressures may prove more persistent as a solid labor market allows workers to bargain for higher pay, making it harder to get inflation down further. It’s important for the Central Bank to continue to monitor how the economy performs over the coming months, since a slowdown in core inflation could create a new problem for the Federal Reserve if there is reason to believe the improvement will only last for a short period of time.

Source: WSJ