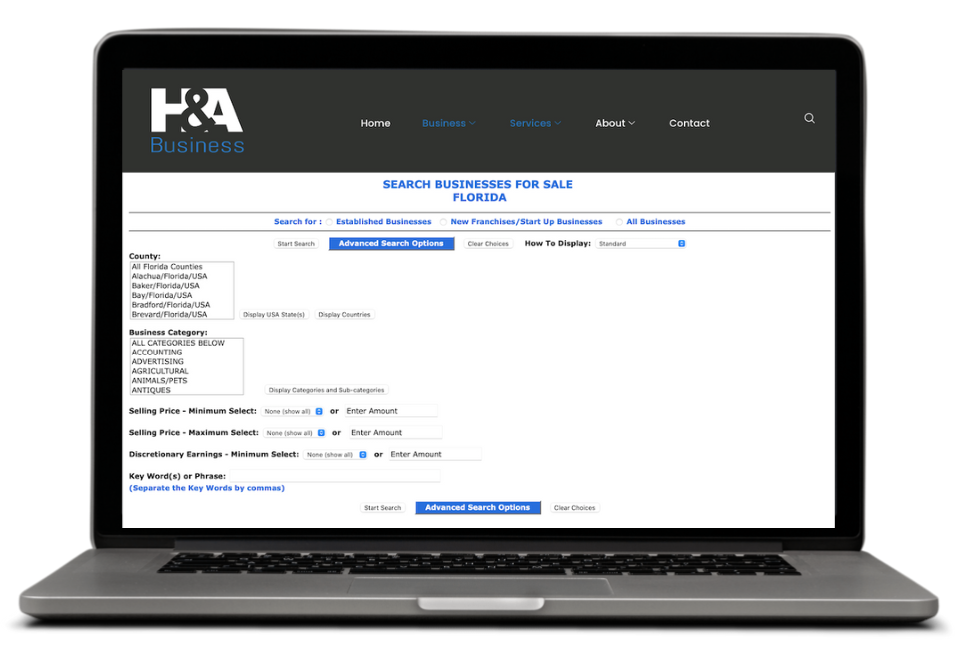

SEARCHING FOR A BUSINESS TO BUY: TIPS FOR SUCCESS

When contemplating buying a business, it’s helpful to start looking at businesses for sale and find out what businesses are available and how they are priced. This will give you an idea of how much money you may need to buy a business. Consider your strengths and weaknesses, hobbies, and previous jobs that you’ve enjoyed […]

SEARCHING FOR A BUSINESS TO BUY: TIPS FOR SUCCESS Read More »