Record Growth in Q2 2024

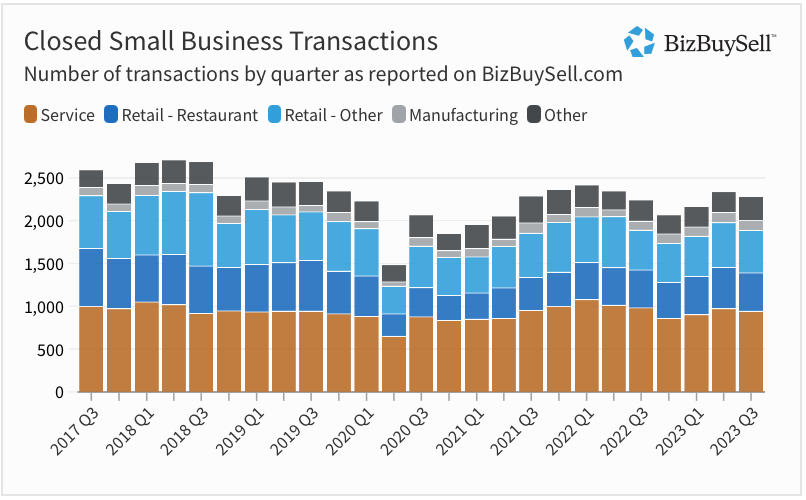

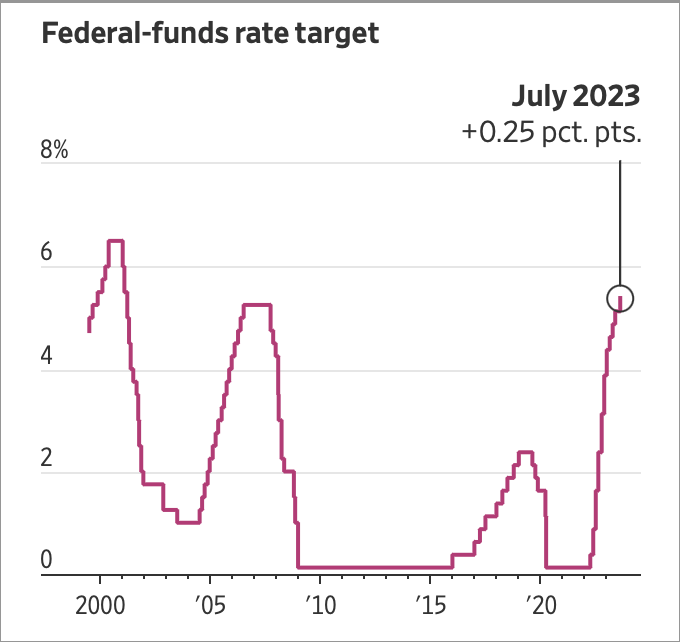

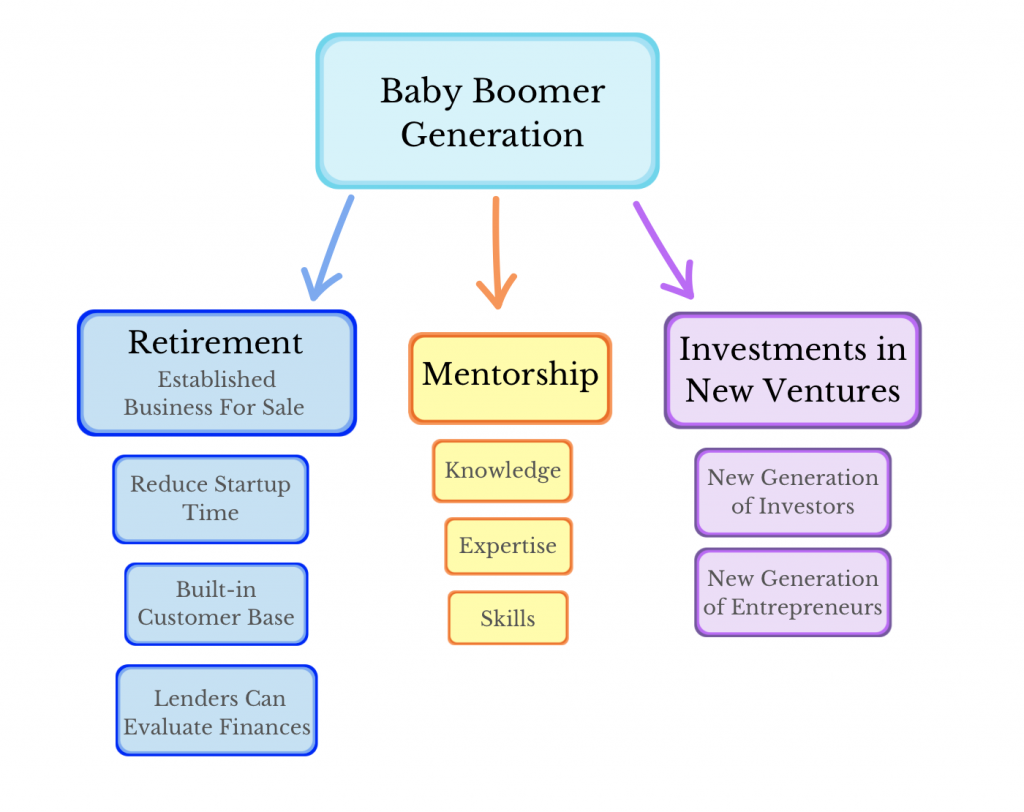

Business Sales Surge Amid Stabilizing Economy In the second quarter of 2024, the business sales market demonstrated remarkable growth, with 2,448 businesses sold, representing a total enterprise value of $1.9 billion. This marks a 20% increase […]

Record Growth in Q2 2024 Read More »