GROWING POPULARITY AMONG RESTAURANTS AND NICHE VENUES

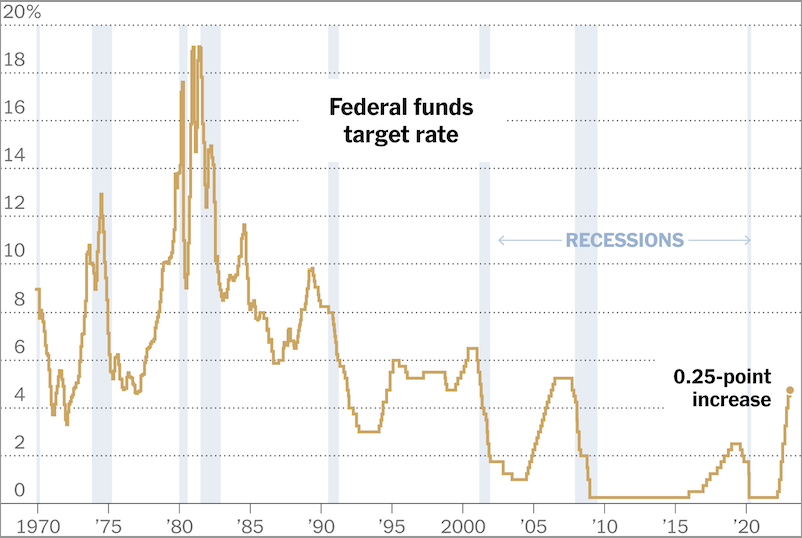

In the aftermath of two years of COVID restrictions, restaurants that were struggling are experiencing a significant increase in demand for dining out and socializing with friends in local restaurants. A growing number of niche establishments that offer quality, unique products at an affordable price are also becoming more popular as inflation continues to be […]

GROWING POPULARITY AMONG RESTAURANTS AND NICHE VENUES Read More »